Understanding the Process Behind an Online Tax Return in Australia and How It Functions

Understanding the Process Behind an Online Tax Return in Australia and How It Functions

Blog Article

Simplify Your Finances: How to Submit Your Online Tax Obligation Return in Australia

If come close to carefully,Filing your online tax obligation return in Australia need not be a complicated job. Recognizing the intricacies of the tax obligation system and effectively preparing your records are essential primary steps. Picking a reputable online platform can enhance the procedure, but many overlook important information that can impact their total experience. This discussion will check out the necessary components and strategies for simplifying your funds, inevitably resulting in an extra efficient filing procedure. What are the typical challenges to stay clear of, and exactly how can you make certain that your return is accurate and compliant?

Understanding the Tax Obligation System

To navigate the Australian tax obligation system efficiently, it is vital to grasp its essential concepts and framework. The Australian tax system operates on a self-assessment basis, implying taxpayers are liable for properly reporting their revenue and computing their tax obligation obligations. The major tax authority, the Australian Taxes Office (ATO), oversees compliance and imposes tax obligation regulations.

The tax obligation system makes up numerous components, including earnings tax obligation, solutions and products tax obligation (GST), and resources gains tax obligation (CGT), to name a few. Private earnings tax is progressive, with prices raising as revenue increases, while business tax obligation rates differ for small and large organizations. Additionally, tax offsets and deductions are readily available to lower gross income, allowing for even more customized tax obligation responsibilities based on individual scenarios.

Knowledge tax residency is additionally essential, as it identifies a person's tax commitments. Locals are taxed on their globally revenue, while non-residents are only tired on Australian-sourced earnings. Experience with these concepts will certainly equip taxpayers to make informed choices, making certain conformity and possibly optimizing their tax results as they prepare to file their on the internet income tax return.

Preparing Your Files

Collecting the required files is a vital step in preparing to file your on-line tax obligation return in Australia. Correct documents not only simplifies the declaring procedure however likewise guarantees accuracy, minimizing the threat of errors that might cause fines or hold-ups.

Begin by accumulating your revenue declarations, such as your PAYG payment summaries from employers, which detail your incomes and tax obligation kept. online tax return in Australia. If you are freelance, ensure you have your company revenue documents and any appropriate billings. Furthermore, gather bank statements and documents for any kind of rate of interest gained

Following, put together documents of insurance deductible costs. This might include receipts for occupational expenditures, such as uniforms, travel, and tools, as well as any educational expenditures associated with your occupation. If you own home, guarantee you have documents for rental earnings and associated expenses like repair work or home management costs.

Do not fail to remember to consist of various other relevant records, such as your medical insurance details, superannuation contributions, and any kind of financial investment revenue declarations. By thoroughly organizing these documents, you set a solid structure for a efficient and smooth online income tax return process.

Selecting an Online System

After arranging your paperwork, the following step includes picking a proper online platform for filing your tax return. online tax return in Australia. In Australia, several trustworthy systems are available, each offering unique functions tailored to various taxpayer requirements

When selecting an on the internet platform, consider the individual interface and convenience of navigating. An uncomplicated layout can significantly enhance your experience, making it simpler to input your information properly. Furthermore, ensure the system is certified with the Australian Taxation Office (ATO) laws, as this will certainly assure that your entry satisfies all legal requirements.

Systems using live talk, phone assistance, or thorough Frequently asked questions can give beneficial aid if you experience difficulties during the filing procedure. Look for systems that use encryption and have a solid privacy policy.

Lastly, take into consideration the prices related to different systems. While some may supply cost-free services for basic income tax return, others might bill fees for advanced attributes or added support. Weigh these variables to pick the system that aligns finest with your financial scenario and declaring needs.

Step-by-Step Declaring Process

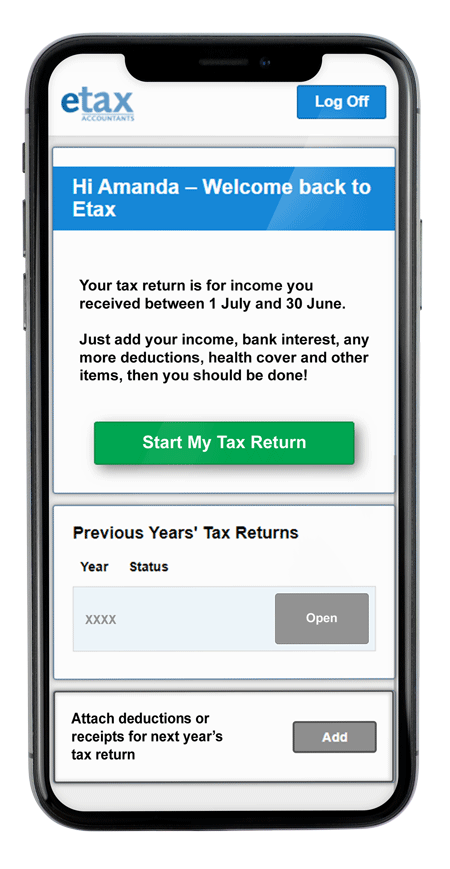

The step-by-step filing procedure for your online income tax return in Australia is designed to improve the entry of your monetary information while making certain conformity with ATO regulations. Started by collecting all required records, including your earnings declarations, bank statements, and any kind of receipts for reductions.

Once you have your records prepared, visit to your chosen online system and produce or access your account. Input your individual details, including your Tax obligation File Number (TFN) and contact details. Following, enter your revenue details properly, guaranteeing to consist of all incomes such as wages, rental earnings, or financial investment profits.

After describing your income, go on to declare qualified deductions. This may consist of work-related costs, philanthropic donations, and clinical expenditures. Make certain to examine the ATO standards to maximize your insurance claims.

After guaranteeing whatever is right, send your tax obligation return online. Check your account for any kind of updates from the ATO concerning your tax obligation return condition.

Tips for a Smooth Experience

Completing your online tax return can be a simple process with the right preparation and frame of mind. To make sure a smooth experience, start by collecting all read this needed papers, such as your earnings statements, invoices for reductions, and any type of other appropriate financial records. This company decreases mistakes and conserves time throughout the declaring procedure.

Following, familiarize on your own with the Australian Tax Office (ATO) website and its online solutions. Utilize the ATO's sources, consisting of guides and Frequently asked questions, to make clear any type of uncertainties prior to you start. online tax return in Australia. Take into consideration setting up a MyGov account connected to the ATO for a streamlined declaring experience

Furthermore, benefit from the pre-fill capability provided by the ATO, which instantly inhabits some of your details, decreasing the opportunity of errors. Guarantee you verify all entries for precision before entry.

Lastly, allow yourself adequate time to complete the return without sensation hurried. This will aid you maintain emphasis and lower anxiousness. If complications occur, don't be reluctant to get in touch with a tax obligation professional or make why not try here use of the ATO's support solutions. Following these ideas can result in a effective and convenient on-line income tax return experience.

Conclusion

In final thought, filing an online tax return in Australia can be streamlined through careful prep work and option of proper sources. he has a good point Ultimately, these methods add to a much more efficient tax obligation declaring experience, simplifying economic monitoring and enhancing compliance with tax obligation commitments.

Report this page